Ad Find all you need to know on your search. Organizational governance and compliance fall under the umbrella term government risk management and compliance GRC.

Governance Risk Compliance Mcglobaltech Your Trusted Security Advisor

Governance Risk Compliance Mcglobaltech Your Trusted Security Advisor

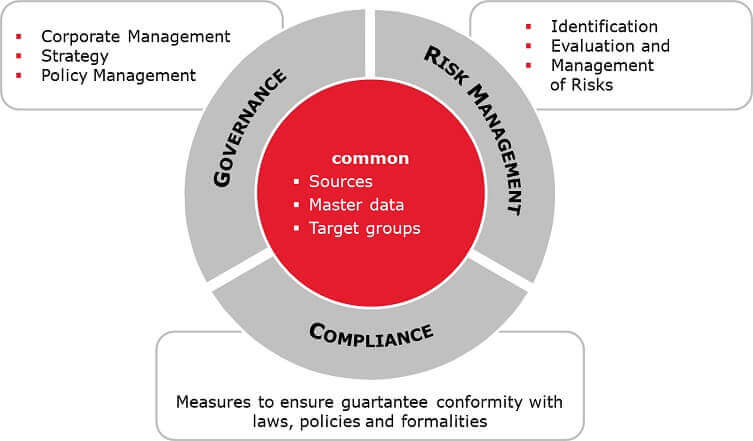

GRC as an acronym stands for governance risk and compliance but the term GRC means much more than that.

Governance and compliance. It refers to a framework of rules policies and procedures that are applied to control the general direction and performance of an organization. Its as easy as that with MySearchExperts. State and Health Canada compliance reporting including CTLS and Metrc so that you can operate legally across regions with varying reporting requirements without disruption.

Access all the information you need. Get a holistic view of internal controls so you can improve governance reduce risk and demonstrate compliance. Access all the information you need.

Another key difference is that corporate governance originates from internal sources while compliance comes externally. Corporate Governance Compliance Corporate Governance is a performance issue Good corporate governance is a foundation attribute for a healthy organisation. Governance provides mechanisms and processes to maintain control over your applications and resources in Azure.

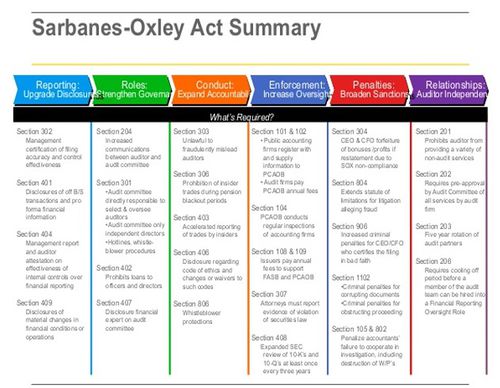

Governance Risk and Compliance GRC refers to a companys strategy for managing the issues of corporate governance enterprise risk management ERM and corporate compliance with data privacy and other regulations. Azure Policy is essential to ensuring security and compliance within enterprise technical estates. Both governance and compliance involve rules of conduct and controls on behavior.

Governance describes a set of rules created by executives and the board of directors in order to set the ethical tone for their company as well as avoid and manage risk. Compliance is more than just about helping your company to avoid fines and mitigate risk. Our objectives require a strong corporate governance foundation.

At Element Solutions we take governance and compliance seriously. Governance Risk Management and Compliance also known as GRC is an umbrella term for the way organisations deal with three areas that help them achieve their objectives. The main purpose of GRC as a business practice is to create a synchronized approach to these areas avoiding repetition of tasks and ensuring that the approaches used are effective and efficient.

Built for our customers most demanding international federal and state compliance requirements CannaBusiness ERP supports GMP standards global compliance and scalability US. Its as easy as that with MySearchExperts. Your ERP is typically the 800-pound gorilla for financial controls but.

A compliance-first approach can build trust save time and help you react quickly to changes in technology laws or customer expectations. Governance risk and compliance GRC refers to a strategy for managing an organizations overall governance enterprise risk management and compliance with regulations. Implementing the suitable Governance Risk and Compliance GRC framework will enable organisations to identify the right approaches which contributes to process efficiency improved risk management and internal controls.

Governance Risk and Compliance GRC Teams. Search on our site. We are committed to operating responsibly and holding ourselves accountable for our actions and decisions.

What is organizational governance and compliance. Then governance becomes a part of innovation not an obstacle. Governance Risk and Compliance Management need to rethink risk and compliance to drive strategy capabilities and performance.

Think of GRC as a. Governance and Compliance is the leading magazine for people working in governance risk and compliance including company secretaries. Implement Consistent GRC Processes Across All Financially Relevant Applications.

In issues of compliance those rules originate from external sources. Search on our site. The OCEG formerly known as Open Compliance and Ethics Group states that the term GRC was first referenced as early as 2003 but was mentioned in a peer reviewed paper by their co-founder in 2007.

Ad Find all you need to know on your search. It sets the tone as to how the organisation operates and behaves both internally and to the market generally. These may be legislation contracts industry standards or other policies that obligate the companys response.