Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification. Business risk management BRM is a strategic process which helps and supports decision making at both strategic and operational levels in an organisation.

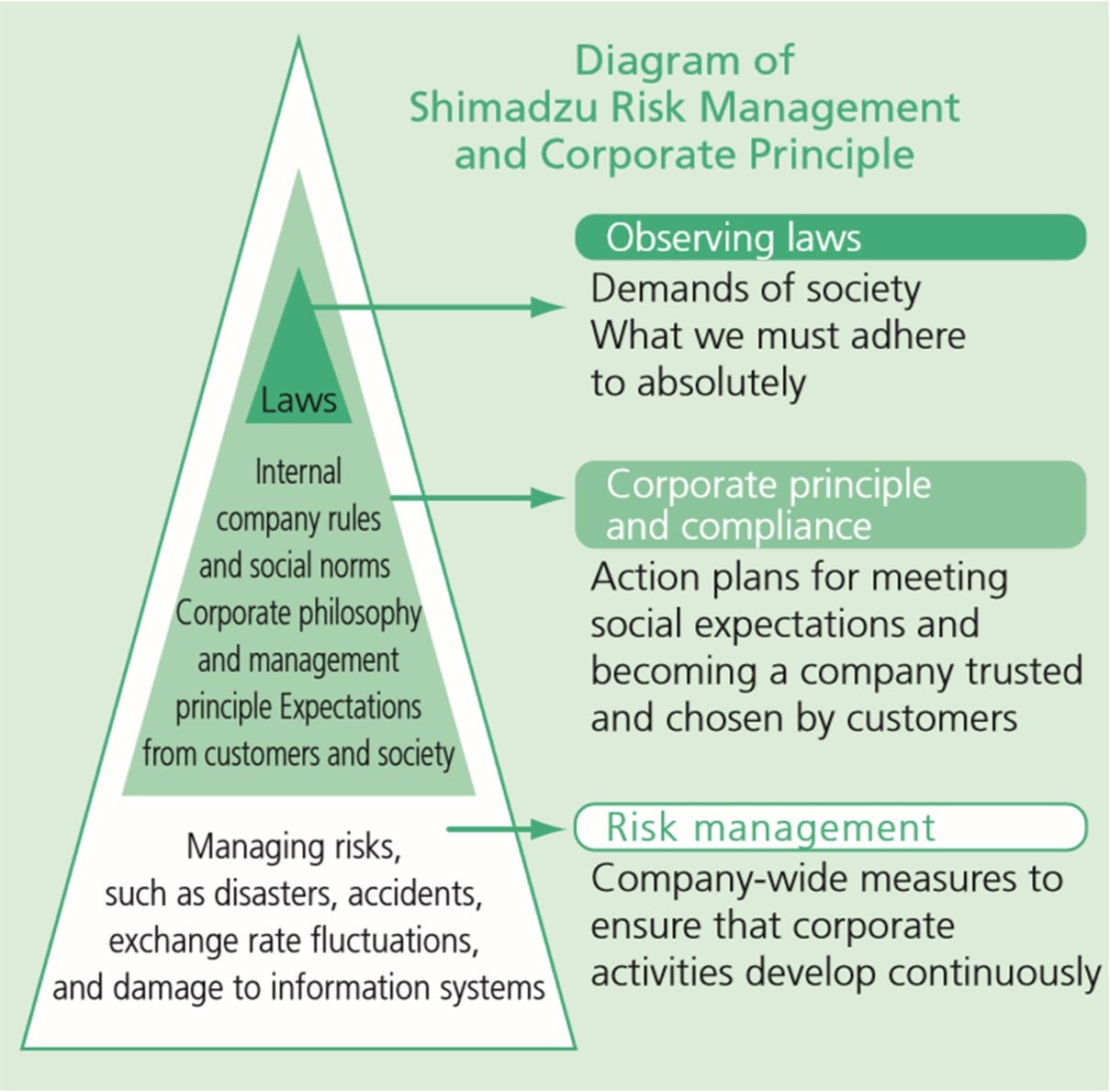

Risk Management Shimadzu Corporation

Risk Management Shimadzu Corporation

What Is Business Risk.

Business risk management. The key is knowing how to do business in a way that protects you and allows you to manage business risk successfully. Improved understanding and management of all risks likely to affect the organisation will lead to better performance and competitive advantage especially when hazards. Anything that threatens a companys ability to.

Ad Risk management solution to identify analyze prioritize and respond to risks. This Business Risk Management online short course from the University of Cape Town UCT is designed to give you a comprehensive overview of the burgeoning field of risk management. Business Risk Management BRM x.

Assess risk create your risk registry plan mitigations and perform management reviews. These assessments will cover threats and risks from a huge range of sources such as financial uncertainty legal issues accidents natural disasters and other IT or data-related threats. In business risk means that a companys or an organizations plans may not turn out as.

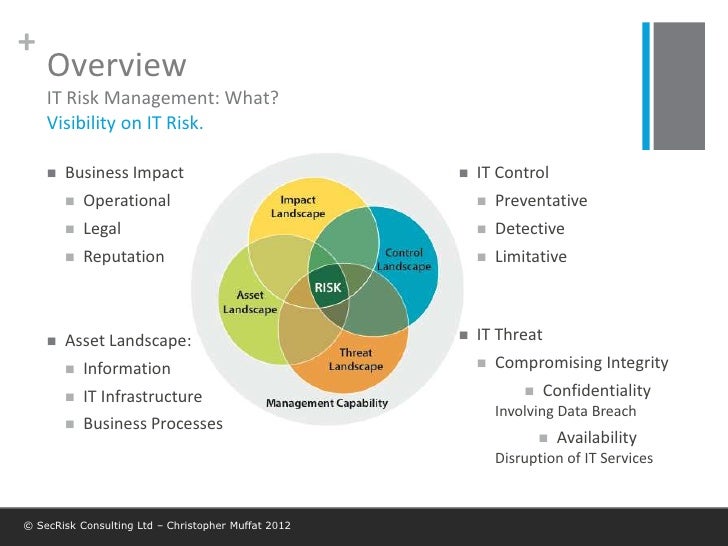

Ad Risk management solution to identify analyze prioritize and respond to risks. Risk management is a strategic business process Dia- gram 1This is aprocess where the organisation met- hodologically evaluates the riskiness of its activities with. Enterprise risk management ERM is a business strategy that identifies and prepares for hazards that may interfere with a companys operations and objectives.

The main focus of enterprise risk management is to establish a culture of risk management throughout a company to handle the risks associated with growth and a rapidly changing business environment. Business risk refers to a threat to the companys ability to achieve its financial goals Earnings Guidance An earnings guidance is the information provided by the management of a publicly traded company regarding its expected future results including estimates. Preparing a risk management plan and business impact analysis The process of identifying risks assessing risks and developing strategies to manage risks is known as risk management.

Risk management refers to the process of identifying assessing and managing or controlling the threats that your business could potentially face. Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers. Pretty much every aspect of business contains risk.

What is Business Risk. Business Risk management is a subset of risk management used to evaluate the business risks involved if any changes occur in the business operations systems and process. It identifies prioritizes and addresses the risk to minimize penalties from unexpected incidents by keeping them on track.

Ad GARP Is the Worlds Leading Professional Organization for Financial Risk Managers. A risk management plan and a business impact analysis are important parts of your business continuity plan. What is risk management.

Every decision you make holds risk. Writing in Bests Review Tim Tongson recommended that business owners take the following steps in implementing an enterprise wide risk management program. Business risk is the exposure a company or organization has to factor s that will lower its profits or lead it to fail.

Youll learn how to promote a strong risk culture in your organisation and recognise the importance of industry compliance. Join an Elite Group of Global Risk Managers by Earning GARPs FRM Certification. Risk is a part of everyday life and the same is true for risk in organisations.

Assess risk create your risk registry plan mitigations and perform management reviews.